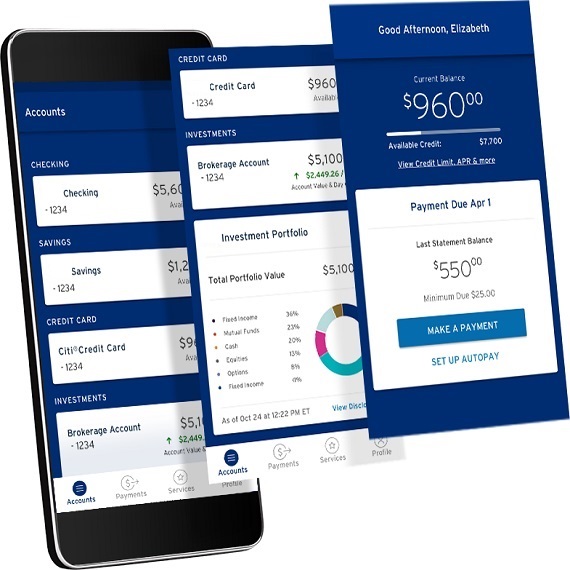

Online banking system

Online banking offers customers almost every service traditionally available through a

local branch including deposits, transfers, and online bill payments. Virtually every

banking institution has some form of online banking, available both on desktop versions

and through mobile apps.

Understanding online banking

With online banking, consumers aren't required to visit a bank branch to complete most of

their basic banking transactions. They can do all of this at their own convenience, wherever

they want—at home, at work, or on the go.

Online banking requires a computer or other device, an Internet connection, and a bank or

debit card. In order to access the service, clients need to register for their bank's online

banking service. In order to register, they need to create a password. Once that's done,

they can use the service to do all their banking.

Advantages of online banking: Convenience is a major advantage of

online banking. Basic banking transactions such as paying bills and transferring funds

between accounts can easily be done 24 hours a day, seven days a week, wherever a consumer

wishes.

Online banking is fast and efficient. Funds can be transferred between accounts almost

instantly, especially if the two accounts are held at the same institution. Consumers can

open and close a number of different accounts online, from fixed deposits to recurring

deposit accounts that typically offer higher rates of interest..

Disadvantages : For a novice online banking customer, using systems for

the first time may present challenges that prevent transactions from being processed, which

is why some consumers prefer face-to-face transactions with a teller.

Online banking doesn't help if a customer needs access to large amounts of cash. While he

may be able to take a certain amount at the ATM—most cards come with a limit—he will still

have to visit a branch to get the rest.

Online banks: Some banks operate exclusively online, with no physical

branch. These banks handle customer service by phone, email, or online chat. Online banking

is frequently performed on mobile devices now that Wi-Fi and 4G networks are widely

available. It can also be done on a desktop computer.

These banks may not provide direct automatic teller machine (ATM) access but will make

provisions for consumers to use ATMs at other banks and retail stores. They may reimburse

consumers for some of the ATM fees charged by other financial institutions.